Asked by Amanuel Mengistab on Apr 27, 2024

Verified

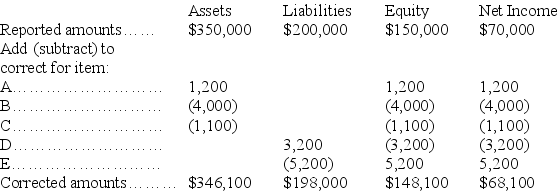

A company issued financial statements for the year ended December 31,but failed to include the following adjusting entries:

A.Accrued interest revenue earned of $1,200.

B.Depreciation expense of $4,000.

C.Portion of prepaid insurance expired (an asset)used $1,100.

D.Accrued taxes of $3,200.

E.Revenues of $5,200,originally recorded as unearned,have been earned by the end of the year.

Determine the correct amounts for the December 31 financial statements by completing the following table:

Adjusting Entries

Journal entries made in the accounting records at the end of an accounting period to allocate income and expenditures to the period in which they actually occurred.

Accrued Interest Revenue

Income earned from investments that have not yet been received in cash, typically from bonds or loans, and recognized in accounting periods in which they are earned.

Depreciation Expense

The allocation of the cost of an asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

- Elucidate the influence of accounting modifications on financial reports.

Verified Answer

DG

Learning Objectives

- Elucidate the influence of accounting modifications on financial reports.