Asked by Penny Huang on Jul 15, 2024

Verified

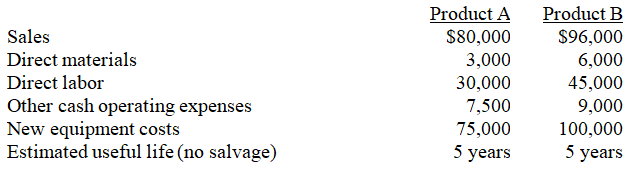

A company is trying to decide which of two new product lines to introduce in the coming year.The predicted revenue and cost data for each product line follows:

The company has a 30% tax rate,it uses the straight-line depreciation method,and it predicts that cash flows will be spread evenly throughout each year.Calculate each product's payback period.If the company requires a payback period of three years or less,which,if either,product should be chosen?

Payback Period

The amount of time it takes for an investment to generate cash flows sufficient to recoup the initial investment cost.

Straight-Line Depreciation

Straight-Line Depreciation is a method of allocating the cost of a tangible asset over its useful life in equal annual amounts, reflecting a constant rate of depreciation.

- Implement calculations and explicate the outcomes of assorted capital financing strategies.

Verified Answer

OV

Orlando VillafaneJul 20, 2024

Final Answer :

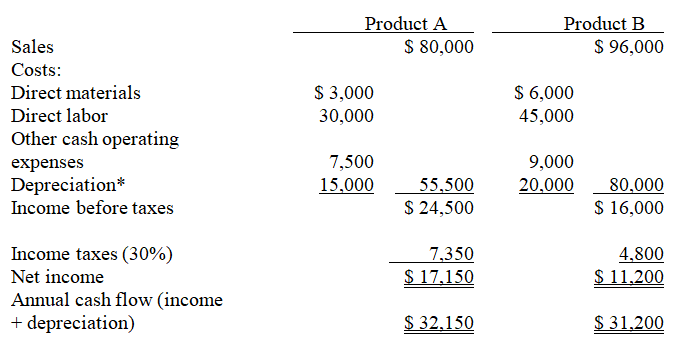

*Annual depreciation:

A = $ 75,000/5 yrs. = $15,000; B = $100,000/5 yrs. = $20,000

Payback periods:

(A) ($75,000/$32,150) = 2.3 years; (B) ($100,000/$31,200) = 3.2 years

Based on the payback period, Product A should be chosen

*Annual depreciation:

A = $ 75,000/5 yrs. = $15,000; B = $100,000/5 yrs. = $20,000

Payback periods:

(A) ($75,000/$32,150) = 2.3 years; (B) ($100,000/$31,200) = 3.2 years

Based on the payback period, Product A should be chosen

Learning Objectives

- Implement calculations and explicate the outcomes of assorted capital financing strategies.

Related questions

A Company Is Considering Two Projects,Project a and Project B ...

For Each of the Capital Budgeting Methods Listed Below,place an ...

The Net Present Value Decision Rule Requires That When an ...

The Simple Rate of Return, Rate of Return on Assets ...

Which Methods of Evaluating a Capital Investment Project Ignore the ...