Asked by Daisy Farhm on Jul 14, 2024

Verified

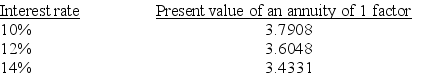

A company is considering a 5-year project.It plans to invest $62,000 now and it forecasts cash flows for each year of $16,200.The company requires a hurdle rate of 12%.Calculate the internal rate of return to determine whether it should accept this project.Selected factors for a present value of an annuity of 1 for five years are shown below:

Hurdle Rate

A financial metric indicating the minimum return on investment required for a project or investment to be considered acceptable.

Internal Rate of Return

A financial metric used to estimate the profitability of potential investments, calculating the discount rate that makes the net present value of all cash flows from the investment equal to zero.

Present Value

The present value of a future amount of money or a series of cash flows, calculated using a given interest rate.

- Compute the internal rate of return (IRR) and understand its role in investment decisions.

Verified Answer

BO

brianna outramJul 18, 2024

Final Answer :

Investment/Annual net cash flows = $62,000/$16,200 = 3.827.

The present value factor of 3.827 falls below 10%.This project earns less than 10%.If the hurdle rate is 12%,this project should be rejected.‾\underline{rejected.}rejected.

The present value factor of 3.827 falls below 10%.This project earns less than 10%.If the hurdle rate is 12%,this project should be rejected.‾\underline{rejected.}rejected.

Learning Objectives

- Compute the internal rate of return (IRR) and understand its role in investment decisions.