Asked by Dayna McCormick on Jun 12, 2024

Verified

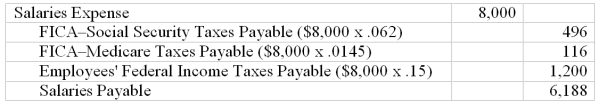

A company has 2 employees. The company's total salaries for the month of January were $8,000. The federal income tax rate for both employees is 15%. The FICA-social security tax rate is 6.2% and the FICA-Medicare tax rate is 1.45%. Calculate the amount of employee taxes withheld and prepare the company's journal entry to record the January payroll assuming these were the only deductions.

FICA-Social Security

A U.S. government program funded by payroll taxes, providing retirement benefits, disability income, and survivor benefits.

- Develop accounting entries for the execution of payroll, including the allocation of payroll and recording of payroll taxes expense.

- Ascertain the entire amount of FICA withholdings for employees, derived from their gross salary.

Verified Answer

CM

Learning Objectives

- Develop accounting entries for the execution of payroll, including the allocation of payroll and recording of payroll taxes expense.

- Ascertain the entire amount of FICA withholdings for employees, derived from their gross salary.

Related questions

During December 2016 Apartment Publishing Sold 2500 12-Month Annual Magazine ...

Hair Affairs Reports the Following Payroll Information for May, 2010 ...

Mansour Company Makes Sales on Which an 8% Sales Tax \( ...

Prepare the General Journal Entry to Record the Payroll ...

Prepare the General Journal Entry to Record the Employer's Payroll ...