Asked by Hunter McGaughey on Jun 09, 2024

Verified

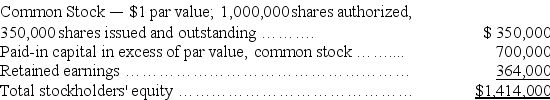

A company had the following stockholders' equity on January 1:

On January 10,the company declared a 40% stock dividend to stockholders of record on January 25,to be distributed January 31.The market value of the stock on January 10 prior to the dividend was $20 per share.What is the book value per common share on February 1?

On January 10,the company declared a 40% stock dividend to stockholders of record on January 25,to be distributed January 31.The market value of the stock on January 10 prior to the dividend was $20 per share.What is the book value per common share on February 1?

Stock Dividend

A payment made by a corporation to its shareholders in the form of additional shares, rather than cash.

Book Value

The net value of a company's assets minus its liabilities, often used to assess its financial position.

Common Share

A type of equity ownership in a corporation, giving shareholders voting rights and a share in the company's profits through dividends.

- Understand the effects of stock dividends and stock splits on company's equity and share value.

Verified Answer

ZS

Zainab SaeedJun 10, 2024

Final Answer :

Total stockholders' equity does not change; however,the number of shares outstanding is now 350,000 shares + (350,000 shares * .40)= 490,000 shares.

Book value per share = $1,414,000/490,000 shares = $2.89/common share

Book value per share = $1,414,000/490,000 shares = $2.89/common share

Learning Objectives

- Understand the effects of stock dividends and stock splits on company's equity and share value.