Asked by Maria Rodarte on Jul 04, 2024

Verified

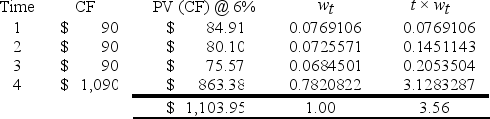

A bond pays annual interest. Its coupon rate is 9%. Its value at maturity is $1,000. It matures in 4 years. Its yield to maturity is currently 6%.

The modified duration of this bond is ________ years.

A) 4

B) 3.56

C) 3.36

D) 3.05

Coupon Rate

The annual interest rate paid by a bond's issuer to its bondholders, usually expressed as a percentage of the bond's face value.

Yield To Maturity

The total return anticipated on a bond if the bond is held until its maturity date, considering all interest payments and the principal repayment.

Modified Duration

A measure of the sensitivity of a bond's price to changes in interest rates, reflecting the change in the bond’s price for a 1% change in yield.

- Master the techniques and outcomes associated with bond duration and modified duration analysis.

Verified Answer

PM

Learning Objectives

- Master the techniques and outcomes associated with bond duration and modified duration analysis.

D* = 3.56/1.06 = 3.36 years

D* = 3.56/1.06 = 3.36 years