Asked by Rebecca Rivera on Jun 13, 2024

Verified

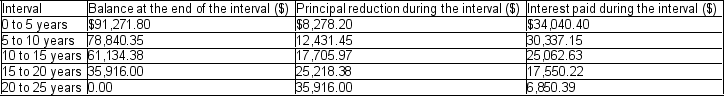

A $100,000 mortgage loan at 7.2% compounded semi-annually requires monthly payments based on a 25-year amortization. Assuming that the interest rate does not change for the entire 25 years, complete the following table.

Compounded Semi-annually

The method of determining interest by adding it to both the original amount of money deposited or borrowed and the interest that has already been added over two periods within a year.

Amortization

The process of paying off a debt over time through regular payments.

- Develop and analyze amortization schedules.

- Evaluate the consequences of interest rate modifications on monthly dues and cumulative interest charges.

Verified Answer

LD

Learning Objectives

- Develop and analyze amortization schedules.

- Evaluate the consequences of interest rate modifications on monthly dues and cumulative interest charges.