Asked by Sharath Rajendran on Apr 25, 2024

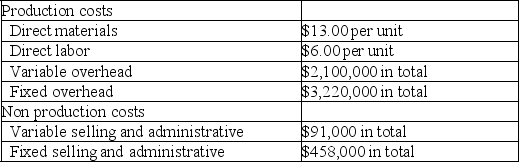

32 Degrees,Inc.,a manufacturer of frozen food,began operations on July 1 of the current year.During this time,the company produced 140,000 units and sold 140,000 units at a sales price of $125 per unit.Cost information for this period is shown in the following table:

a.Prepare 32 Degree's December 31st income statement for the current year under absorption costing.

a.Prepare 32 Degree's December 31st income statement for the current year under absorption costing.

b.Prepare 32 Degree's December 31st income statement for the current year under variable costing.

Absorption Costing

A method of inventory costing in which all costs of production (both variable and fixed) are treated as product costs.

Variable Costing

Variable Costing is an accounting method that only allocates variable costs to inventory and cost of goods sold, excluding fixed manufacturing overhead from inventory valuation.

Income Statement

A financial statement that reports a company's financial performance over a specific accounting period, showing revenues, expenses, and net income.

- Evaluate the impact that methods of distributing costs have on the financial statements, considering several costing practices.

Learning Objectives

- Evaluate the impact that methods of distributing costs have on the financial statements, considering several costing practices.